(See Steps) According to the Quantitative Theory of Money, inflation will be positively related to the rate of monetary growth, and inversely related to the

Question:

According to the Quantitative Theory of Money, inflation will be positively related to the rate of monetary growth, and inversely related to the rate of real economic growth.

It analyzes the following information on the average annual rates of inflation, the average annual rate of money growth, and the average annual rate of growth in real GDP in 16 Latin American countries during the 1950-69 period.

| Country | Inflation y | Money Growth X1 |

PIB growth

real X2 |

| Argentina | 26.4 | 24.6 | 2.4 |

| Bolivia | 41.3 | 41.6 | 3.0 |

| Brazil | 35.1 | 38.2 | 3.9 |

| Chile | 28.2 | 35.2 | 4.6 |

| Colombia | 9.2 | 16.5 | 5.4 |

| Costa Rica | 1.9 | 9.0 | 5.7 |

| Ecuador | 3.0 | 8.8 | 4.7 |

| El Salvador | 0.3 | 3.5 | 4.6 |

| Guatemala | 1.1 | 5.9 | 3.9 |

| Honduras | 2.1 | 8.0 | 4.0 |

| México | 5.3 | 11.3 | 6.9 |

| Nicaragua | 3.4 | 8.6 | 3.7 |

| Paraguay | 12.5 | 15.4 | 5.5 |

| Perú | 8.5 | 13.4 | 5.7 |

| Uruguay | 43.0 | 40.1 | 0.7 |

| Venezuela | 1.1 | 7.9 | 6.8 |

Answer the following:

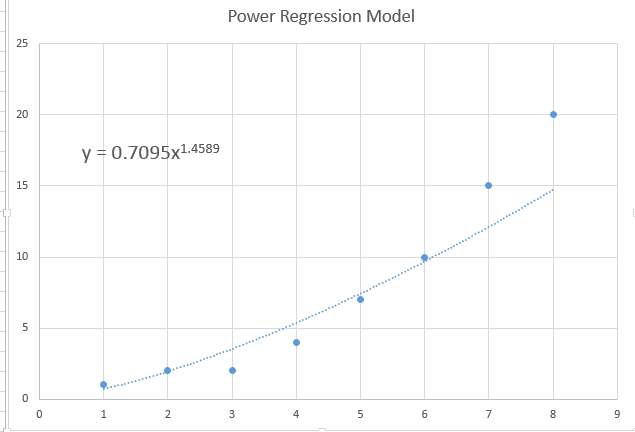

- Estimate the multiple linear regression model to explain the annual inflation rate through the rate of money growth and growth in real GDP.

- How much does the annual inflation rate change on average for a 1% increase in the annual rate of money growth? How much does the annual inflation rate change on average for a 1% increase in the annual rate of growth in real GDP?

- Observing the multiple linear correlation matrix, what is the variable that has a greater linear relationship on the annual inflation rate?

- What is the fit of the model? In this case, which one is more advisable to use, the R2 or R2 - adjusted and why?

Deliverable: Word Document

![[Step-by-Step] One of the main measures of quality in the service provided [Step-by-Step] One of the main measures of](/images/solutions/MC-solution-library-44926.jpg)

![[See Steps] You have the task of verifying that the publicity of [See Steps] You have the task of](/images/solutions/MC-solution-library-44927.jpg)

![[Solution Library] A group of teachers of math course and a group [Solution Library] A group of teachers of](/images/solutions/MC-solution-library-44928.jpg)

![[See Steps] A fabricant of analgesics is morally obliged to put [See Steps] A fabricant of analgesics is](/images/solutions/MC-solution-library-44929.jpg)

![[All Steps] The data in the BEER archive represent the Price of [All Steps] The data in the BEER](/images/solutions/MC-solution-library-44930.jpg)