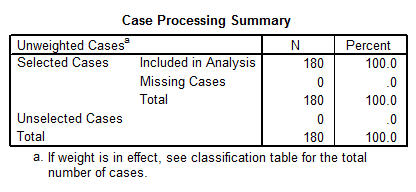

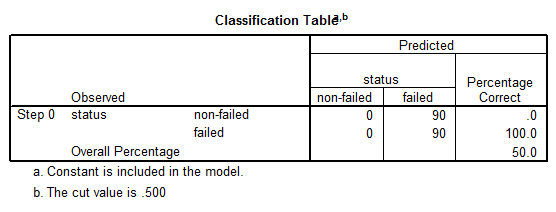

The following logistic regression output has been made available which was run on a sample of 90 fai

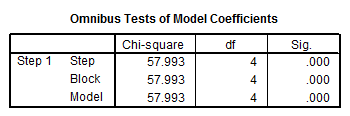

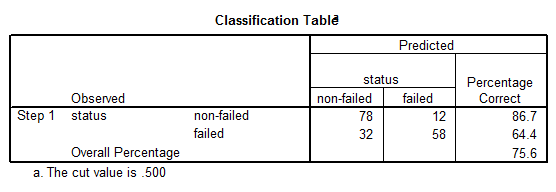

Question: The following logistic regression output has been made available which was run on a sample of 90 failed UK companies and 90 non-failed companies matched by year and industry. The following notation is used:

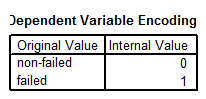

Status is the dependent variable which takes a value of 1 for a failed company and 0 for a non-failed company.

pm1 is the after-tax profit margin in the year prior to failure.

de1 is the debt to equity ratio in the year prior to failure.

tasls1 is the total assets to sales ratio in the year prior to failure.

slsg2_1 is the sales growth rate in the year prior to failure.

Logistic Regression

[DataSet1] H:\harddisc\SUSG & Market PS.sav

Block 0: Beginning Block

Block 1: Method = Enter

You are required to write a report explaining the meaning of this information and critically assessing the performance of the estimated model from both a financial and statistical perspective.

Deliverable: Word Document

![[Solved] The amounts (in ounces) of juice in eight randomly selected juice bottles are: 15.4 15.7 15.2 15.8 1 #15782 Other Statistics](/images/downloads-images/featured/Statistics-question-11566.jpg)

![[Solved] Under what circumstances would it be appropriate to also use other measures of variability and what #11568 Hypothesis Testing - Chi Square Test](/images/downloads-images/featured/Statistics-question-21402.jpg)