Solution: [40 marks] Long question, based on 2015 Exam: Consider an economy where each generation lives for two time periods. Consumption of a particular

Question: [40 marks] Long question, based on 2015 Exam: Consider an economy where each generation lives for two time periods. Consumption of a particular generation when young and old is denoted by c and c’ respectively. Assume there is no population growth, so any time half of the population is young and half of the population is old. The young each receive labour income y (labour supply is inelastic). The old are retired and receive no labour income. There is a credit market where anyone can save and earn real interest rate r. The labour income of the young grows at rate g between generations ( \(y'/y=1+g\) ).

Suppose the government levies a proportional income tax t on the incomes of the young. The government also pays out pensions to the old that are a fraction b of the current young’s labour incomes (i.e. if the current young earn y, the current old receive by). Note that this says nothing about how these pensions are funded. The present value of a generation’s lifetime after-tax income including pensions is:

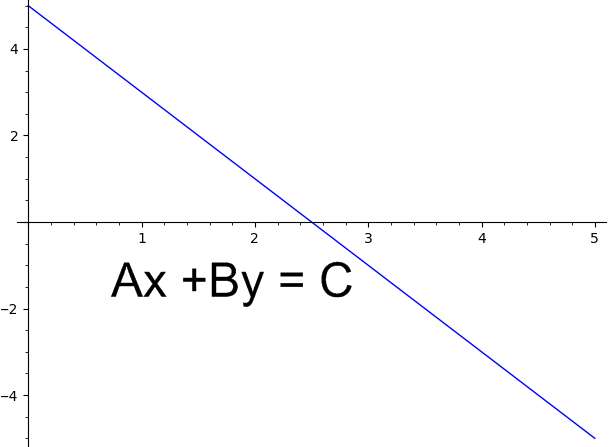

\(we=\left( 1-t \right)y+\frac{by'}{1+r}\)

First suppose the government’s pensions system is fully funded, meaning that the taxes collected from the young are invested and the proceeds are used to fund their future pensions when old.

- [5 marks] Assuming the government earns the same real return r as households do on their savings, write down an equation linking t and b. Show that this fully-funded pension system has no effect on households’ consumption plans and explain what impact it has on the savings \(s=\left( 1-t \right)y-c\) of the young.

-

[5 marks] Explain why your findings in part (a) are an illustration of the "Ricardian equivalence" principle. Is it possible that your answers would be different if households were unable to borrow?

Now suppose instead that the government has a ‘pay-as-you-go’ pensions system, meaning that taxes collected from the young are used to pay the pensions of the current old. - [10 marks] Write down an equation linking t and b under this pension system, and use this to find an expression for life-time wealth we in terms of y, t, r, and g only.

- [10 marks] Explain why the current old would gain from the introduction of the pay-as-you-go pension system, and find the condition for the current young generation to benefit from it as well. Assuming this condition is satisfied and the system is introduced, find the effects on the consumption and saving of the young. Explain why the ‘Ricardian equivalence’ principle does not apply to this type of pension system.

- [10 marks] Now suppose that the growth rate g falls, but the condition derived in part (d) continues to hold. Two options for reforming the pay-as-you-go pension system are: (i) maintaining contributions t and cutting benefits b; or (ii) increasing contributions t and maintaining benefits b. Compare the effects of these two reforms on the current old and young generations. Is it possible to say which reform is preferable?

Deliverable: Word Document

![[See Steps] a) John Wilson, the owner of a fast food restaurant, [See Steps] a) John Wilson, the owner](/images/solutions/MC-solution-library-73994.jpg)

![[All Steps] a) You are the manager of a monopoly that faces a [All Steps] a) You are the manager](/images/solutions/MC-solution-library-73995.jpg)

![[See Steps] a) The manager of an Electronic Corporation has estimated [See Steps] a) The manager of an](/images/solutions/MC-solution-library-73996.jpg)

![[See Solution] (a) Briefly describe each type of variable (b) Using [See Solution] (a) Briefly describe each type](/images/solutions/MC-solution-library-73997.jpg)

![[Solved] Assess the heart rate variable for its distribution at [Solved] Assess the heart rate variable for](/images/solutions/MC-solution-library-73998.jpg)