(See Steps) Consider a consumer with $1000 and utility-of-wealth function u(w)=√w, who cares only about money at the end of the current year. He is debating

Question: Consider a consumer with $1000 and utility-of-wealth function \(u\left( w \right)=\sqrt{w}\), who cares only about money at the end of the current year. He is debating how much to deposit in a savings bond, which will pay guaranteed return rate of 5% in the next year, and how much to spend on twitter stock, which will pay a return rate of 100% with probability p, and a return rate of -200% with probability 1 – p.

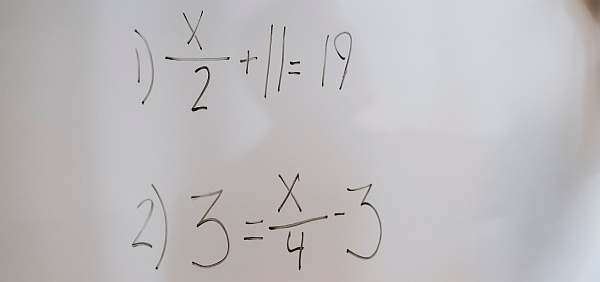

- Calculate the expected return rate, variance, and standard deviation of twitter stock (this will depend on p)

- Suppose he deposits a fraction \(\alpha \) of his wealth in the savings bond, and the remaining fraction (1- \(\alpha \) ) in twitter stock.

- Calculate his final wealth level if the twitter stock goes up and pays return rate 100% (this happens with probability p)

-

Calculate his final wealth level if the twitter stock goes down and pays return rate

.200% (this happens with probability 1- p) - Using your answers to (i) and (ii), calculate his expected utility.

(c) Write out the equation you would solve to find the optimal fraction \(\alpha \) that he should invest in the savings bond. (You do not need to actually calculate the number).

Deliverable: Word Document

![[Solved] Calculate the following gamble: you currently have $200, [Solved] Calculate the following gamble: you currently](/images/solutions/MC-solution-library-72813.jpg)

![[See Solution] Assume that the demand and supply functions of [See Solution] Assume that the demand and](/images/solutions/MC-solution-library-72816.jpg)