(See Solution) You borrow $500,000 to purchase a house. The mortgage is a 30-year fixed rate mortgage, with monthly payments. Assume that you have good

Question: You borrow $500,000 to purchase a house. The mortgage is a 30-year fixed rate mortgage, with monthly payments.

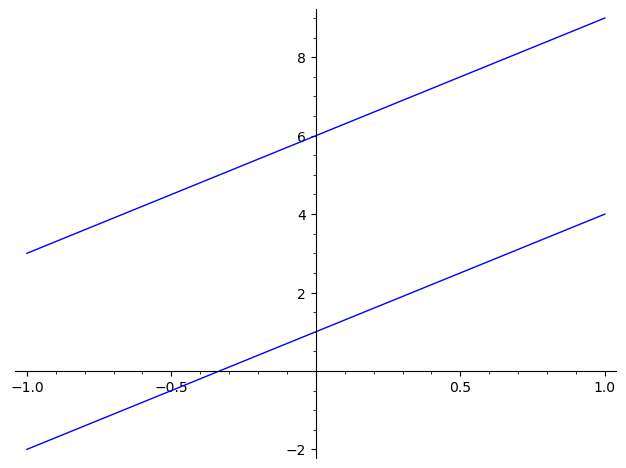

- Assume that you have good credit, and can borrow money at a 3.75% annual interest rate. What will your monthly payment be?

- Now, assume that you have lousy credit, and must pay a 6.5% annual interest rate to obtain a mortgage. What will your monthly payment be?

- Having lousy credit can be costly. How much additional interest will you pay over the 30-year period if you have bad credit, relative to what you would pay if you have good credit? (Hint: Calculate the total interest over the 30-year period on the loan in Part A, and the total interest over the 30-year period for the loan in Part D. What is the difference between the two amounts?).

- Explain why it is not necessarily unethical for banks to charge people with poor credit histories higher interest rates (within reason, of course)?

Price: $2.99

Solution: The downloadable solution consists of 1 pages

Deliverable: Word Document

![[Solution Library] A $1000 face value bond has a 4 percent coupon, [Solution Library] A $1000 face value bond](/images/solutions/MC-solution-library-77504.jpg)

![[Solution Library] Scooby Industries just received a patent on [Solution Library] Scooby Industries just received a](/images/solutions/MC-solution-library-77507.jpg)

![[Steps Shown] On the distant planet of Zurg, the stock market [Steps Shown] On the distant planet of](/images/solutions/MC-solution-library-77508.jpg)