(Solution Library) Analyze the inventory account and answer the following questions using the financial statements and notes to the financial statements: Explain

Question: Analyze the inventory account and answer the following questions using the financial statements and notes to the financial statements:

- Explain what inventory is for these specific types of companies. Which financial statement shows inventory? What section of the statement does this account appear? What has been the dollar change from the past year for each company? Make sure you identify the dollar amount change and if it is an increase or decrease.

- Using the footnotes or notes to the financial statements identify the inventory costing method each company is primarily using. Provide the page number of the note you are referencing.

-

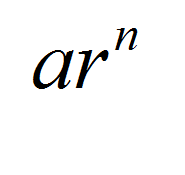

Compute the average days inventory outstanding for the current and past year for each company and show your calculations. Review pages 6-12 and 6-13, which shows the formula as 365 times Average Inventory/ Cost of Goods Sold. To determine the average inventory use the current year and past year inventory divided by 2, since the ending inventory of one year is the beginning inventory of the next year. Cost of Goods Sold is the same thing as Cost of

Sales

. Round to the nearest day. You can find this information on the current 10-K except for the

following

information for

201

6

Inventory for

JCP $2,721 in millions

and

KSS $4,038 in millions

.

Comment on your results including a comparison of the 2 companies.

You must show your work to earn full credit.

Current year Past year JCP ((2,762+2,854)/2)/(8,174/365) = 125.387815 \[\approx \] 125 days ((2,854+2,721)/2)/(8,071/365) = 126.060897 \[\approx \] 126 days KSS ((3,542+3,795)/2)/(12,176/365) = 109.970639 \[\approx \] 110 days ((3,795+4,038)/2)/(11,944/365) = 119.6854069 \[\approx \] 120 days

Comments: The average days inventory outstanding provides a measure of how long it takes for a company to turn its inventory. In this case both companies have similar performances, only that Kohl's take slightly shorter than J.C. Penney at turning its inventories. -

Does the company face any inventory

related

risk? You need to use the 10-K Part 1A Risk Factors for both companies and find

one

risk factor that

relates

to inventory.

Comment

on this risk factor you picked for each company.

Provide the page number

that you are referencing in this question.

Price: $2.99

Solution: The downloadable solution consists of 3 pages

Deliverable: Word Document

![[Steps Shown] Given the data you have and the belief that a relationship [Steps Shown] Given the data you have](/images/solutions/MC-solution-library-76957.jpg)