[Solution Library] According to Investment Digest ("Diversification and the Risk/Reward Relationship," Winter 1994, 1-3), the mean of the annual return for

Question: According to Investment Digest ("Diversification and the Risk/Reward Relationship," Winter 1994, 1-3), the mean of the annual return for common stocks from 1926 to 1992 was 15.4%, and the standard deviation of the annual return was 24.5%. During the same 67-year time span, the mean of the annual return for long-term government bonds was 5.5%, and the standard deviation was 6.0%. The article claims that the distributions of annual returns for both common stocks and long-term government bonds are bell-shaped and approximately symmetric. Assume that these distributions are distributed as normal random variables with the means and standard deviations given previously.

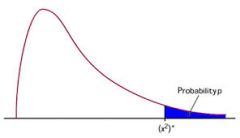

- Find the probability that the return for common stocks will be greater than 0%.

- Find the probability that the return for common stocks will be less than 20%.

Hint: There are many ways to attack this problem in the HW. If you would like the normal distribution table so you can draw the pictures then bookmark this site:

http://www.statsoft.com/textbook/sttable.html

Deliverable: Word Document

![[See Steps] A large candy manufacturer is concerned that the mean [See Steps] A large candy manufacturer is](/images/solutions/MC-solution-library-55314.jpg)

![[Solution] (a, b) ~ (c, d) iff ab>cd show whether its reflective, [Solution] (a, b) ~ (c, d) iff](/images/solutions/MC-solution-library-55315.jpg)