(Answer) The city of , (or is it Taxes) needs to determine the - #80068

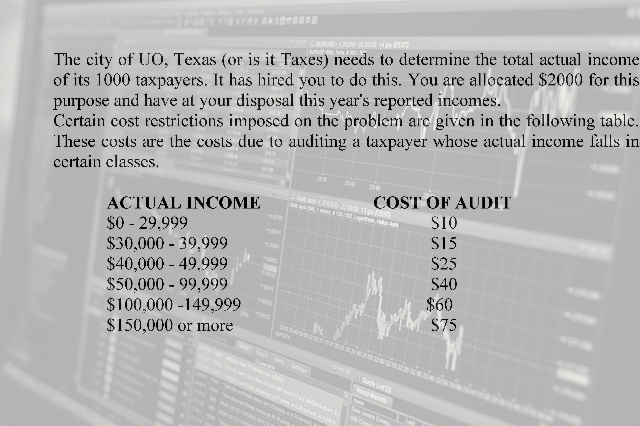

The city of UO, Texas (or is it Taxes) needs to determine the total actual income of its 1000 taxpayers. It has hired you to do this. You are allocated $2000 for this purpose and have at your disposal this year's reported incomes.

Certain cost restrictions imposed on the problem are given in the following table. These costs are the costs due to auditing a taxpayer whose actual income falls in certain classes.

ACTUAL INCOME COST OF AUDIT

$0 - 29,999 $10

$30,000 - 39,999 $15

$40,000 - 49,999 $25

$50,000 - 99,999 $40

$100,000 -149,999 $60

$150,000 or more $75

· Under the above cost restrictions you are to sample and estimate the total actual income of the city of UO.

.· What are the taxpayer numbers that constitute your sample? Taxpayer numbers are to be put in ascending order (smallest to largest)

· Describe how you sampled (strata, strata sample sizes, etc.)

· Discuss:

o (1)how you designed your survey and why,

o (2) how you analyzed the data in your survey and why,

o (3) problems you encountered and

o (4) the results of your survey, your estimate of the total income, the estimated variance, the bound on the error of estimation, and your sampling costs.

Penalty

Lose 1 point for every $20 you go over budget.

Deliverable: Word Document

and pdf

and pdf