(Steps Shown) A company is deciding whether or not to purchase a piece of land that it could develop into a shopping centre sometime in the next 6 years.

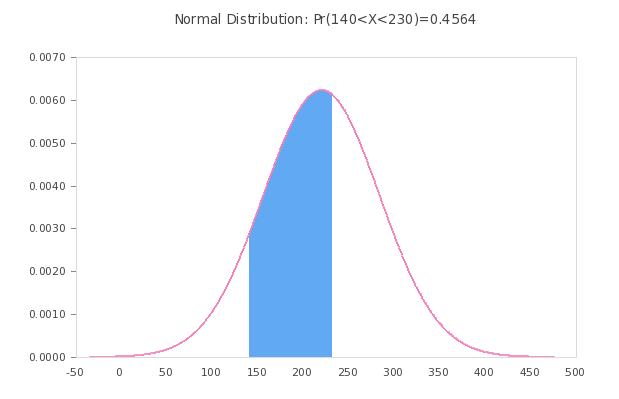

Question: A company is deciding whether or not to purchase a piece of land that it could develop into a shopping centre sometime in the next 6 years. The land is on sale for $4,000,000. The cost of building the shopping centre is $76,000,000, not counting the purchase price for the land. The risk free rate is 0.06. The company added a risk premium of 0.16 to obtain a discount rate for calculating the present value of future revenues over the lifetime of the shopping centre of 0.22. Using this discount rate they determined that the present value of the revenue for the shopping is $71,000,000 so using NPV it is not currently worth building the shopping centre- However the company wishes to perform a real options analysis to determine if it is worth purchasing the land now for the option to build the shopping centre later. it expects the present value of the revenue to have an annual volatility of 0-43. it will use a binomial lattice covering a period of 6 years using 12 time steps to decide if it is worth purchasing the land. So far they have determined the values of u and d for the binomial lattice given below. What are the values that they should use for P(u) and P(d)? (Answer to 3 decimal places.)

Deliverable: Word Document

![[All Steps] A company is developing a mine for an ore body containing [All Steps] A company is developing a](/images/solutions/MC-solution-library-78467.jpg)

![[Solved] An airline requires a new passenger jet. There are two [Solved] An airline requires a new passenger](/images/solutions/MC-solution-library-78468.jpg)

![[Step-by-Step] Combinatorial Identities (16 Step-by-Step Solution](/images/solutions/MC-solution-library-78469.jpg)